FINANCE AND HOUSING PROGRAM

-

First Time Homebuyer's Class

My First Home

My First Home Class Schedule - Virtual Classes

To view the upcoming class schedule and register, please visit https://rb.gy/knoeeq

Note: You will be redirected to the Orange County Extension office to complete your registration. This class is valid for Osceola County participants, and a certificate of completion will be issued to you once you participate in the class.

If you have any questions, please contact:

UF/IFAS Extension Orange County 407-254-9200

Jenny Rodriguez, Faculty FCS Extension Agent II

Email: jennyarodriguez@ufl.eduShireen Campell Riley, Orange County Staff

Email: s.campbellriley@ufl.edu

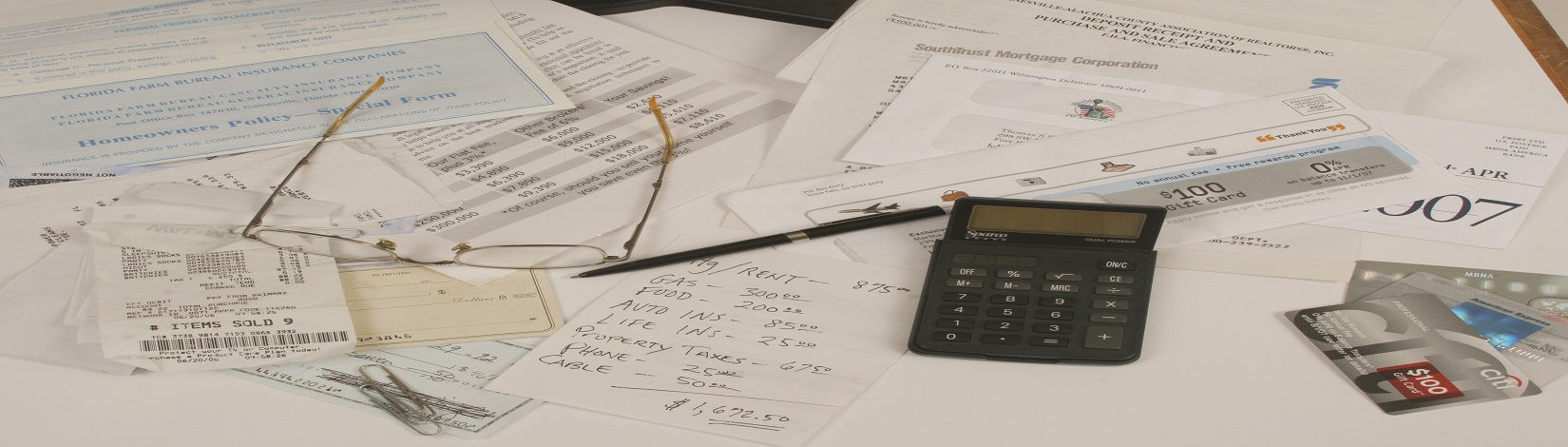

“My First Home” is a first-time homebuyer class open to all individuals interested in buying a home. If you are seeking to apply for the Osceola County S.H.I.P. Downpayment Assistance program or need a HUD Certified class to apply for a down-payment assistance, this class is a pre-requisite to qualifying for assistance. All applicants, co-signers, and spouses will need to receive a class certificate.

Please Note: This class does not guarantee that you will be eligible to receive funds towards purchasing a home but rather helps you meet one of the requirements to apply.

ONLINE registrations only. We accept debit or credit cards through Eventbrite—no cash or checks accepted.

For information on the Osceola County SHIP program or funds availability, contact 407-742-8400 or SHIP@osceola.org or visit SHIP-Purchase-Assistance-Down-Payment-Assistance

Foreclosure Prevention reference information:

NOT RELATED TO UF

In Charge Debt Solutions Main Number: 407-791-7770 x 5894

In Charge Debt Solutions Housing Department/Foreclosure Prevention: 877-251-1882

Clear Point Foreclosure Prevention Phone Counseling - 800-750-2227

-

Take Control of Your Money/Upcoming Classes

Upcoming Classes - click here

Money Management

Note: You will be redirected to the Orange County Extension office to complete your registration. This class is valid for Osceola County participants, and a certificate of completion will be issued to you once you participate in the class.

If you have any questions, please contact:

UF/IFAS Extension Orange County 407-254-9200

Jenny Rodriguez, Faculty FCS Extension Agent II

Email: jennyarodriguez@ufl.eduStretching Your Dollar

Managing Your Debt

-

Save Your Home From Foreclosure

Having trouble paying your mortgage? Don't wait until it's too late! Call the UF/IFAS Extension in Orange County at 407-254-9200 to speak with a HUD certified counselor about your options or attend a Mortgage Foreclosure Prevention Clinic.

Mortgage Foreclosure Prevention

reference information:

NOT RELATED TO UF

In Charge Debt Solutions Main Number: 407-791-7770 x 5894

In Charge Debt Solutions Housing Department/Foreclosure Prevention: 877-251-1882

Clear Pont Foreclosure Prevention Phone Counseling - 800-750-2227

New Attorney General's Foreclosure Settlement Could Help You

By now you may have heard of the $25 billion National Mortgage Servicing Settlement. With the cooperative efforts of 49 state attorney generals, the Federal government reached an agreement that is holding the nation's five largest loan servicers (Ally Financial, Bank of America, Citigroup, J.P. Morgan Chase and Wells Fargo) accountable for their actions. The settlement is requiring them to provide relief to distressed homeowners and those who lost their home from January 1, 2008 through December 31, 2011.Consider working with a HUD Certified Counselors. They Can:- Evaluate your current situation and ability to repay

- Help you establish a monthly budget

- Contact the lender to help negotiate options

- Help you evaluate all options and explain each one

To find out if you qualify for the Making Home Affordable Program or to speak to a HUD-certified counseling agency, call (888) 995-4673. -

Renter's Rights and Foreclosure

Until recently, the lease that you signed with your landlord would have ended with the foreclosure. The following provides useful information to help a renter who is living in a foreclosed property understand their rights under Federal law.

What Should I do Now That My Property is Being Foreclosed?

Your landlord’s lender, usually a bank, takes possession of the house or sells the home in a public auction. Sometimes this happens even before the foreclosure is finalized. The first thing a bank usually does is start the process of evicting any tenants and emptying the house so that the house can be turned around and sold as quickly as possible. During this time, the new owners of the property usually do not make repairs or pay the utility bills so that any remaining occupants are “persuaded” to leave.

Protecting Tenants at Foreclosure Act of 2009

This law protects renter’s interest (including Section 8 tenants) during a foreclosure process in one of two ways:

- Renters with no lease or a month-to-month lease must be given at least 90 days' notice before they are required to vacate the property.

- If the tenant has a lease lasting longer than a month, the renter is permitted to remain in the home for the duration of the lease. Only after their lease expires can the evictions proceed. There is an exception made for buyers of the foreclosed property who intend to live in the home. For these cases, only 90-days' notice must be given before breaking the lease.

Please note: If the state of Florida law provides better protection for renters, then the state law overrides the federal Protecting Tenants at Foreclosure Act of 2009.

If you are thinking of moving out early, one option to consider is “cash for keys”. With cash for keys, the new property owner pays you to leave the property before the end of your lease. If you leave the rental clean and in good condition, you can receive anywhere from $250 to $2,500. This sum usually depends on the value of the house, what items you agree to leave behind and the new owner.

What Should You do About Your Previous Landlord?

A starting point for talking with your previous landlord would be to discuss what to expect and the possibility of recovering deposits as early as possible. After the landlord and the tenant sign the lease, they have a legally binding document. The landlord is legally bound to deliver the rental during the lease, which was violated when the property went into foreclosure. Because of this, the tenant can sue their former landlord for moving and house-searching costs, application fees and any differences in rent you might incur by having to move. Also, beware for an unscrupulous landlord who will continue to collect their tenant’s rent payments, even after they are no longer the legal owners of the property. If this happens, you may want to explore your options with filing a small claims case in court. Keep in mind that your original property owner is probably hard-pressed for money right now and that awards for cases like these are usually relatively small. However, with a little time and effort, you could eventually get all that is owed to you.

-

Home Safety Checklist