Farm Business Financial Plan

A Farm Financial Plan is a comprehensive document that outlines the financial strategy and requirements for operating a farming enterprise. It includes several components:

- A description of the funding requirements of the farm business: The plan specifies the capital needed to start or continue farming operations, covering costs for equipment, land, labor, and materials (such as seeds, fertilizers, etc.) to manage day-to-day expenses.

- Provides detailed information on break-even analysis: It assesses the minimum level of production or sales required to cover all fixed and variable costs, helping to identify the point at which the farm will start generating profits.

- Projected income statements, cash flow, & balance sheets: These financial statements forecast the farm's future performance:

- Income statements show projected revenues, expenses, and profits over a given period.

- For an income statement example, click here.

- Cash flow statements track the movement of cash in and out of the farm, ensuring sufficient funds are available to meet operational needs.

- For a cash flow statement example, click here.

- Balance sheets provide a snapshot of the farm’s assets, liabilities, and equity at a specific point in time, helping to assess financial health and stability.

- For a balance sheet example, click here.

- Income statements show projected revenues, expenses, and profits over a given period.

-

Determining funding Requirements

Funding will be determined by the following:

- Investment costs (establishment costs): how much you need to invest to get your business started.

- Please see these establishment costs of avocados in South Florida as an example: https://edis.ifas.ufl.edu/publication/FE956

- Operational costs: annual costs to run your business.

- Financial necessities: money you need to keep your business going.

- Sales plan: the amount of product you will need to sell to cover your costs.

- Investment costs (establishment costs): how much you need to invest to get your business started.

-

Farm Assets

The assets of a farm business are valuable resources used to operate and grow the farm. They can be divided into two main categories:

- Current Assets (short-term): These are assets that are expected to be converted into cash or used up within a year. They include:

- Cash and cash equivalents: Money available for use.

- Accounts receivable: Money owed by customers.

- Inventory: Crops, livestock, feed, seeds, fertilizer, etc.

- Prepaid expenses: Payments made in advance for future services.

- Non-Current Assets (long-term): These are long-term assets that the farm intends to use for more than one year and are essential for the farm's operations. They include:

- Land: Property used for the farming business.

- Buildings and structures: Barns, silos, greenhouses.

- Machinery and equipment: Tractors, plows, harvesters.

- Reproductive Livestock: Animals raised for breeding.

- Vehicles: Trucks and trailers for transportation.

- Improvements and infrastructure: Fencing, irrigation systems, etc.

- Current Assets (short-term): These are assets that are expected to be converted into cash or used up within a year. They include:

-

Farm Liabilities

Farm liabilities are the financial obligations or debts that a farm business owes to others. They are classified into two main types:

- Current Liabilities (short-term): These are debts that need to be paid within a year, such as:

- Accounts payable: Money owed to suppliers for goods or services received.

- Short-term loans: Loans due within the year, such as operating loans.

- Accrued expenses: Unpaid expenses like wages, taxes, or interest.

- Non-Current Liabilities (long-term): These are debts with a repayment period longer than one year, including:

- Long-term loans: Loans for equipment, land, or buildings with a repayment term of more than one year.

- Mortgage debt: Loans secured by the farm's land or property.

- Lease obligations: Long-term rental agreements for equipment or property.

- Current Liabilities (short-term): These are debts that need to be paid within a year, such as:

-

Financial Analysis

The following formulas can help you determine the budget of your farm:

- Return on Investment (ROI): calculated by dividing the profit earned on an investment by the cost of that investment. For instance, an investment with a profit of $100 and a cost of $100 would have an ROI of 1, or 100%, when expressed as a percentage.

- 5% is good for agriculture

- FORMULA:

- Return on Assets (ROA): Adding net farm income (total income minus costs) plus interest expense minus any unpaid labor or management and dividing that total by assets.

- 3% average in farming

- FORMULA:

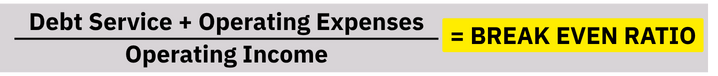

- Break-even Ratio: Percentage of income needed to break even, i.e. for costs to equal expenses.

- FORMULA:

- FORMULA:

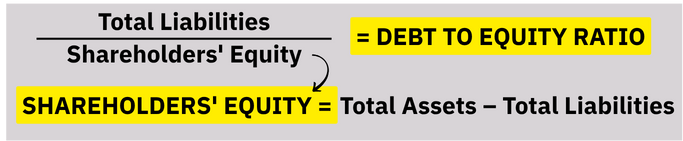

- Debt-to-Equity Ratio: Shows how much debt a company has compared to its assets.

- Less than one to be solvent (can pay off all your debts if you sold everything)

- A good ratio is 0.5

- FORMULA:

- Benefit-Cost Ratio: Determined by dividing the proposed total cash benefit of a project by the proposed total cash cost of the project.

- It needs to be greater than 1 to be profitable.

- FORMULA:

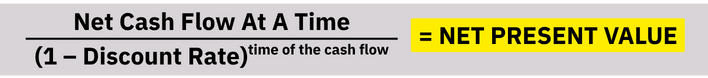

- Net Present Value: For long-term investments calculated over time with a discount rate (usually 5% or the interest rate).

- This determines how long it will take to get what you invest back.

- Important in long-term investments like orchards.

- FORMULA:

- Return on Investment (ROI): calculated by dividing the profit earned on an investment by the cost of that investment. For instance, an investment with a profit of $100 and a cost of $100 would have an ROI of 1, or 100%, when expressed as a percentage.

For more information about specific crop budgets, visit the UF/IFAS website “Food and Resource Economics Department: Commodity Production Budgets”.

CONTACT

Luis O. Rodriguez Small Farms and Pesticide Education Extension Agent I, M.S. (863) 519-1049 lrodriguezrosado@ufl.edu

UF/IFAS Extension Polk County 1702 Highway 17 South Bartow, FL 33830

Hours Monday - Friday 8am - 5pm